Credit Intelligence

Monitor and manage your risk.

Leverage the industry’s most comprehensive business and credit data to find new opportunities, navigate evolving risk, and know who to trust to reach your goals.

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Blue Book offers world-class credit data and in-depth company reviews and rankings that will help you ensure that the right prospects get turned into great customers. That way you can focus on managing profitability vs. collecting late A/R.

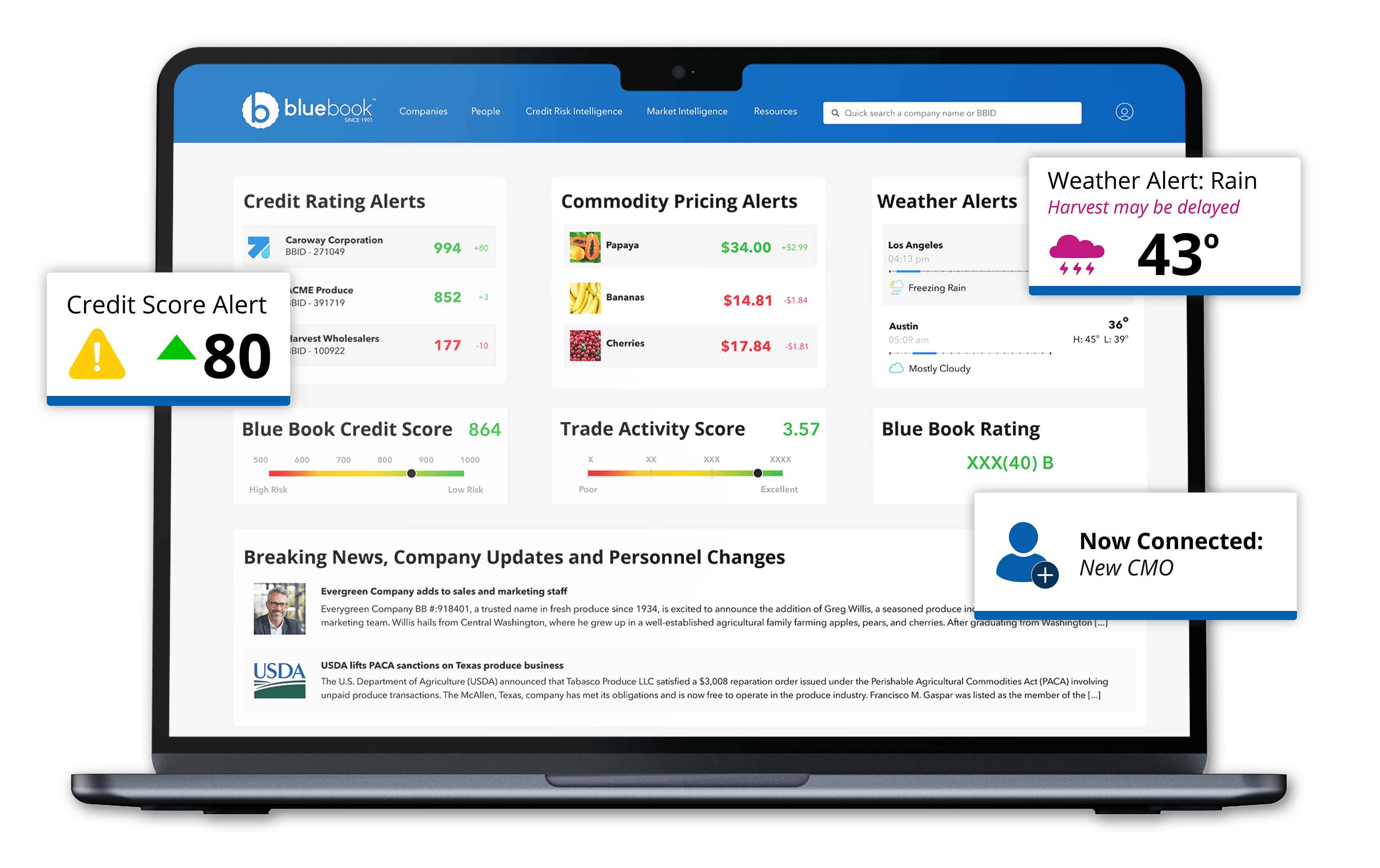

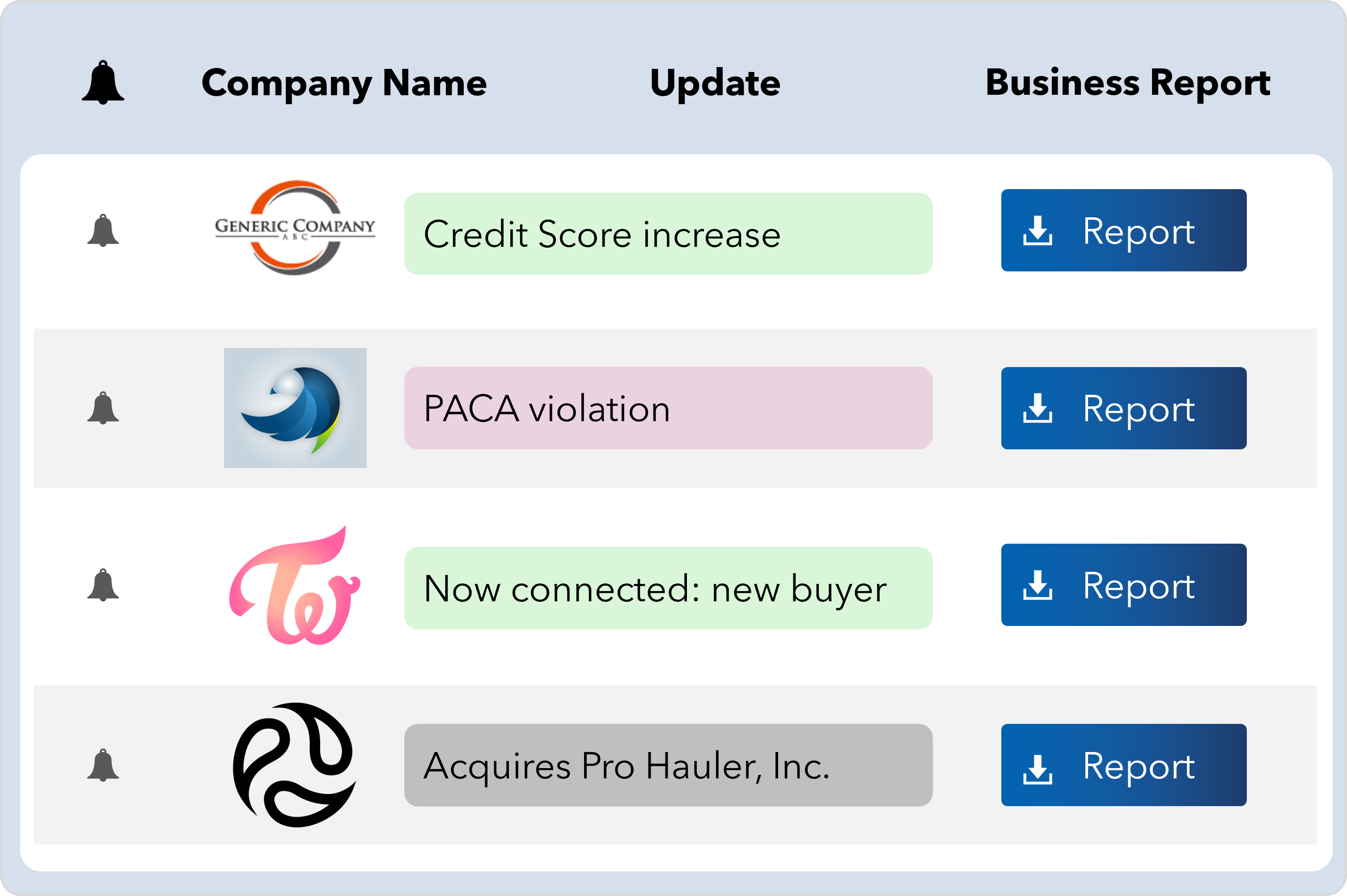

Subscribe to alerts on any company so that you get notifications delivered to your inbox real-time. You’ll never have to worry about missing an update on a key customer or prospect. If a company’s rating changes, you’ll be the first to know, so you can take immediate action.

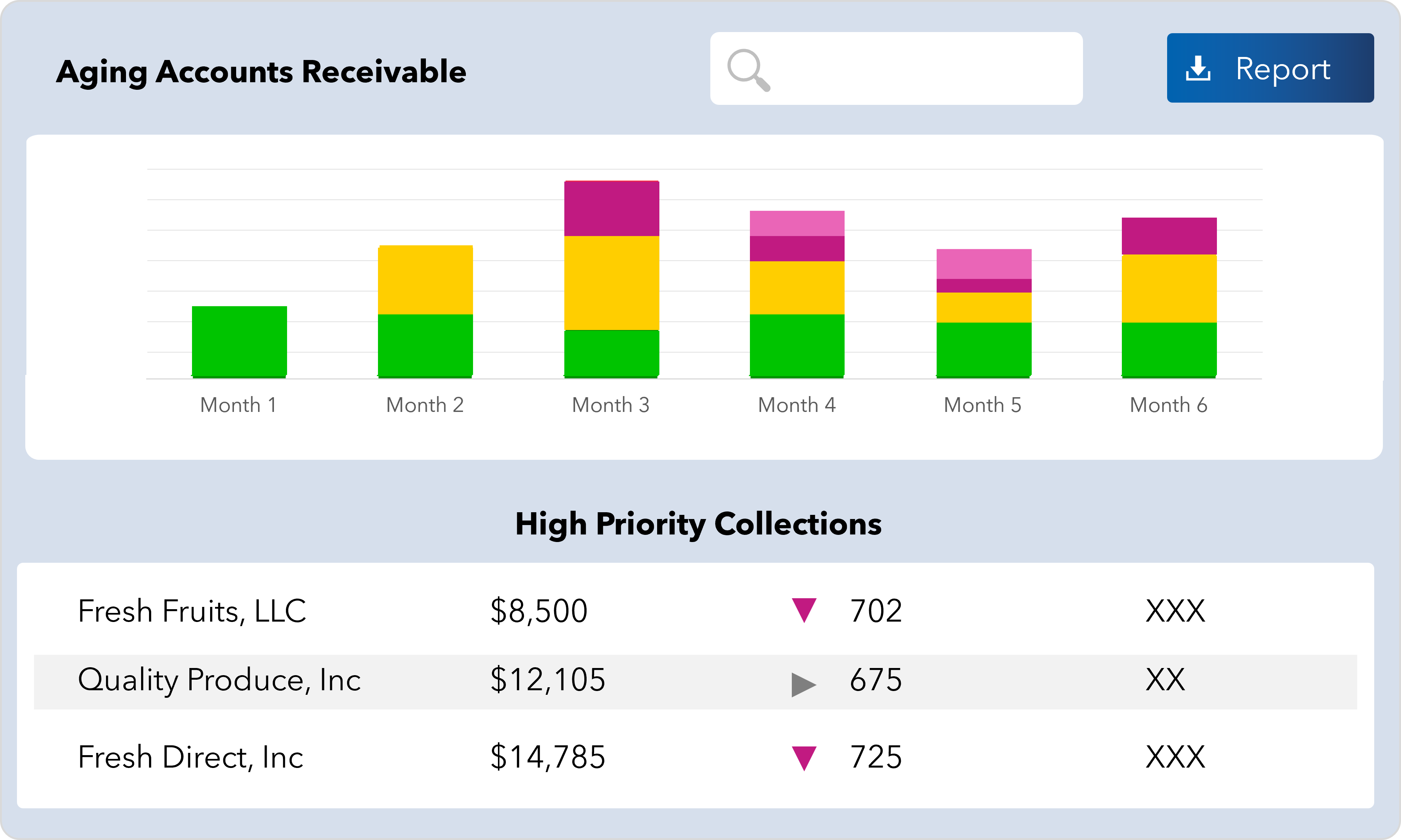

Make confident business decisions with the industry’s most comprehensive data. Blue Book provides you the scores, predictive ratings, and models powered by our data, solutions, and expertise so that you can manage your A/R effectively and focus your attention on your biggest risks.

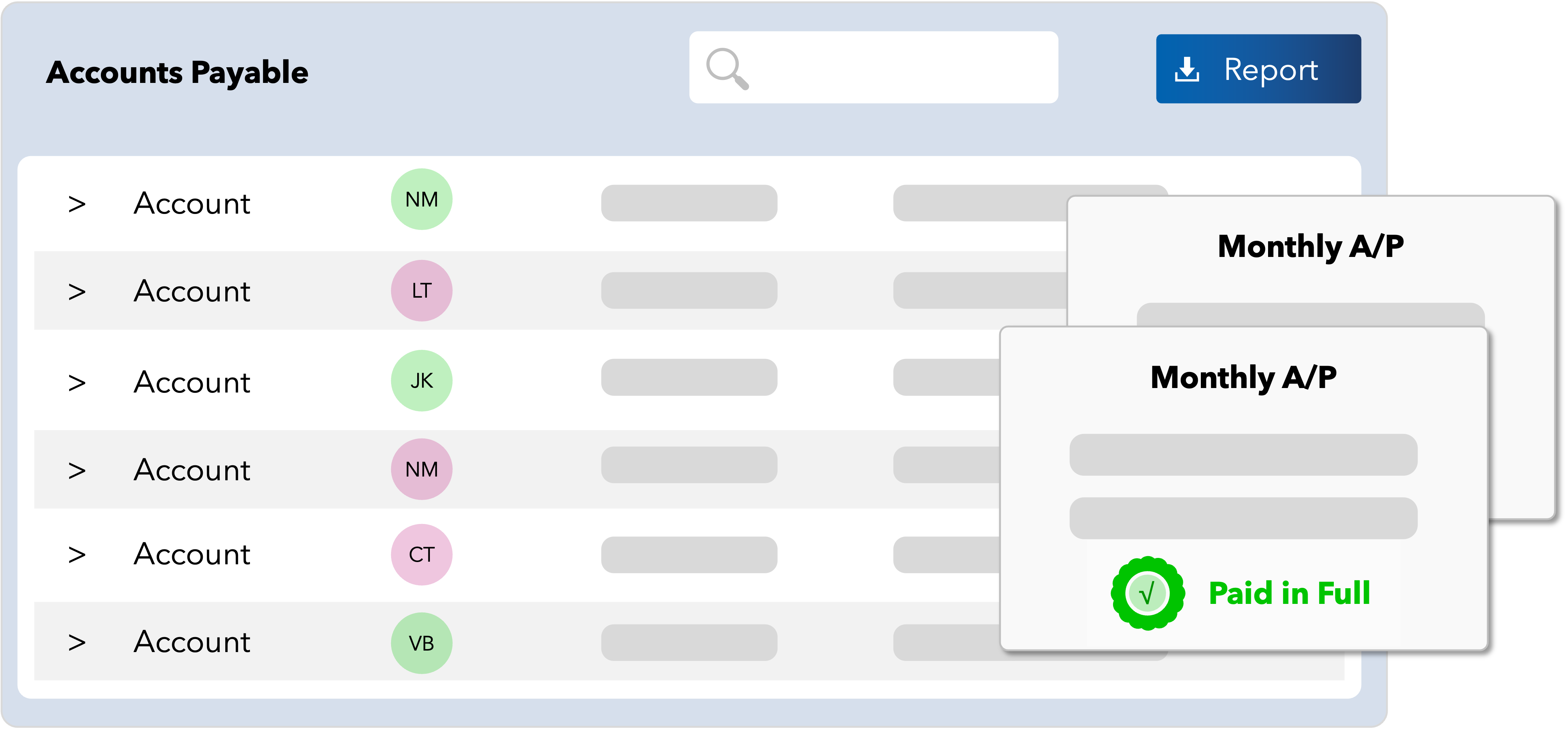

Margins in fresh produce are razor thin, and when a customer slow-pays (or no-pays) you, that has implications for your ability to pay your suppliers or force you to absorb financial losses. Blue Book helps you manage your financial operations – informing bad debt allowances, accounts receivable collection efforts and credit extensions – just to name a few…

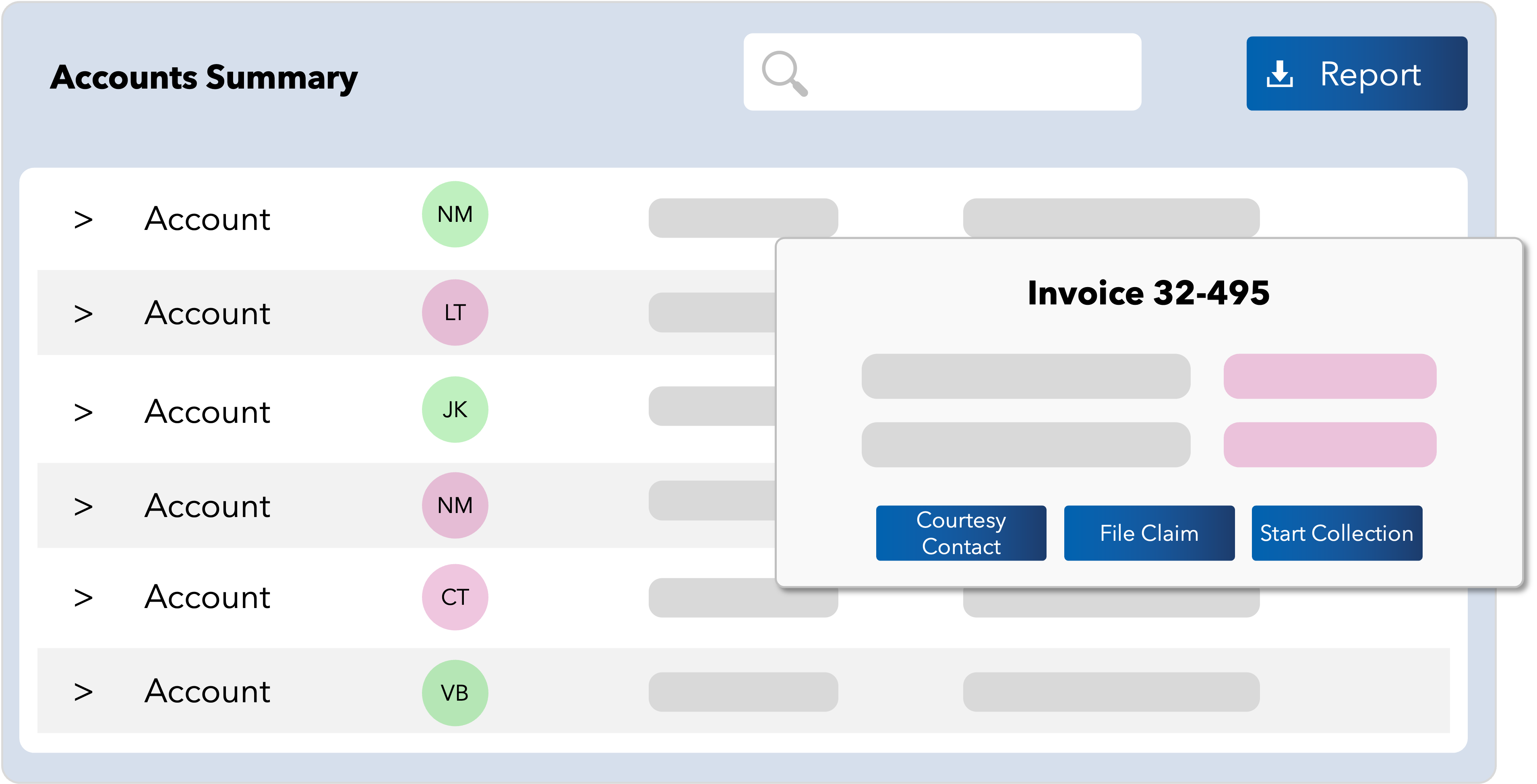

Blue Book mediates tens-of-millions of dollars in trade disputes every year. We’re here to help as an independent party to counsel, advise and mediate. In fact, we literally wrote the book on Trading and Transportation Guidelines. We’re not in the business of interfering in your relationship with a customer or supplier, but we can help you move things forward.

Our solutions are powered by world class capabilities, data and expertise.

With real-time credit alerts you’re instantly notified of any credit update to a customer or prospect.

The only predictive credit score built just for the produce industry, by the produce industry.

Time tested and honed over generations, this provides a snapshot into a company’s credit worth, reliability, and payment speed.

Don’t just take our word for it; this is a real-time peer rating by industry trading partners.

Preview your trading partner for any current or historical trade dispute, PACA violation or lawsuit — easily accessible in one place.

A one-stop-shop for everything you need to know about your trading partner: ownership, payment history, scores, rankings, personnel…we’ve got it all.

Get a live look for how your trading partner is managing their obligations, including quick trend analysis to see if they are paying faster or slower.

Easily request and evaluate a prospect’s credit references with the click of a button.

Data without insight is just noise. Fortunately our tools help you find just the right contact.

How is Blue Book different from other sales lead generation and credit providers?

You can say that our roots run deep in the produce industry. Since 1901, we’ve made it our business to provide the best information to our partners in the produce, transportation and allied service industries. While other firms treat all companies the same, whether you’re a chemical company in China or a smaller farmer in Arizona – Blue Book built the only predictive credit score just for the produce industry, by the produce industry.

What information do you offer in Blue Book?

Blue Book is the hub for the produce and transportation industries. We offer proprietary credit information on ~15,000 companies. We also track key decision makers in the industry and have contact information for about 50,000 buyers and sellers. We provide a curated list of the industry’s daily news stories. Guidelines for commodities and trading guidelines. And our most recent addition is USDA market pricing and movement and hyper-local weather data.

Anything you need – it’s more than likely that we have it!

How much does a Blue Book subscription cost annually?

Blue Book subscription costs are based on two factors: subscription tier and custom add-ons.

Blue Book tiers are based on the depth of information that you might require. Higher tiers offer more robust information (e.g., contact information, credit history, real-time alerts, etc.) about companies.

Add-on solutions to the Blue Book platform and integrations can also impact pricing and packaging. For example, Who’s Viewed My Profile is available as an add-on for organizations that want real-time visibility into when companies are actively searching for them in Blue Book.

Please note, all subscriptions are sold on an annual basis. The prices listed above are shown on a monthly basis to aid in comparison to other subscription platforms.

How do I get started?

Easy! Pick a plan above that best addresses your needs and once you complete payment, you will have live access the same day. Our Customer Success team will be glad to assist you with any trainings or demos. And no worries if you forget something, we’re here to help!

How do I get a listing in Blue Book?

To get listed in the Blue Book, you can apply for membership with Blue Book Services, providing necessary company information and agreeing to adhere to their standards and guidelines.

How does my company get rated?

Blue Book rates thousands of companies across the produce and transportation industry sectors.

To get a Blue Book rating, a business needs to provide basic information about its trading practices, references, and financial statements, and then Blue Book Services will assess the company’s creditworthiness and trading history.

Can Blue Book help me with trading claims, collections and / or dispute resolution?

The simple answer is yes! Blue Book’s Trading Assistance staff is here to help you resolve trading and transportation disputes and collect on past due accounts. We pride ourselves in providing fair and experienced review of all claims.

No fee is charged unless you are paid, and the respondent (or debtor) does not need to be listed in our database before you place a claim.

Family owned grower or national grocer, Blue Book has a plan to help you build, collaborate and succeed

Get a personalized online demo and see what else Blue Book can do for you.