Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

The Problem: Team drivers agreed to, solo driver used.

The Key Point: Proving damages resulting from a late arrival can be difficult or impossible.

The Solution: A liquidated damages provision can be used to help compensate for losses.

QUESTION:

I am a transportation manager for a shipper-distributor based in Florida. We have been paying a $200 premium to a truck broker for teams (as opposed to solo drivers) on vegetable and tomato loads out of Northern California and Nogales, AZ.

We are expecting third-day delivery on the approximately 2,500 mile trips out of Northern California and second-day delivery on the 2,000 mile trips out of Nogales.

On three of the last four loads the broker has moved for us they have been at least one day later than expected with just a solo driver in the truck. On the second load, I informed the truck broker that if this happened again I would deduct $1,000 from the freight bill. I sent the broker a notice of claim this morning, but he is resisting. Is this claim consistent with Blue Book guidelines?

ANSWER:

Per our guidelines, teams are generally expected to cover 1,000 miles a day after the truck is released. So, this is consistent with your expectations. At a minimum, based on your account, you would be able to claim an amount equal to any premium you paid for a team, provided it is documented (e.g., itemized on your confirmation or the broker’s invoices) or if the truck broker acknowledges this premium was paid.

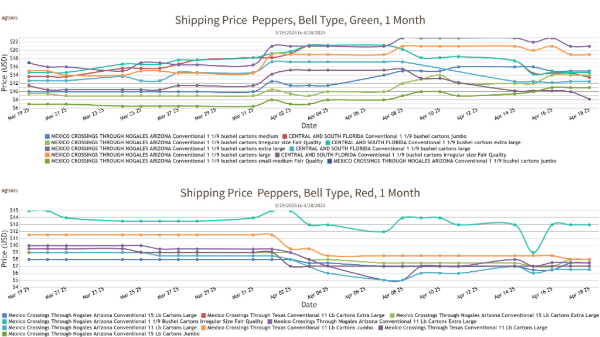

As for damages, you may be entitled to any market decline that occurred during these delays, provided the decline can be supported by the pricing reported by the USDA’s Market News Service. Note that we have not generally recognized claims related to the freshness or condition of the commodity after a one- or two-day delay, because appreciable deterioration is not expected after a one- or two-day delay in the absence of temperature issues in transit. This can frustrate buyers looking to establish damages based on their sales of late delivered product.

Unfortunately, however, even though late trucks may significantly disrupt your business (or your customer’s business), late claims for delays of one or two days often fail because of difficulties proving damages. Therefore, given your truck broker’s failure to solve the problem, we can understand your attempt to impose a late fee after repeated instances of late arrival.

But in order to enforce a liquidated damages provision, you will need to be prepared to show that (1) this $1,000 damages provision was agreed upon; and (2) the amount was a good-faith estimate of your losses and not punitive. Here, as we read your question, it sounds as though this $1,000 late fee is not an estimate of damages so much as a penalty for this pattern of lateness and providing solo drivers when teams were specified.