Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

Trade with confidence... every time.

Blue Book’s real-time alerts help you stay up to speed with everything in the produce industry

General Mills backs new GrubMarket investment, company now valued at $2 billion

A new $120MM in equity backed by General Mill’s investment arm has pushed San Francisco-based GrubMarket BB #:301166 to a reported $2 billion in value, according to a...

A new $120MM in equity backed by General Mill’s investment arm has pushed San Francisco-based GrubMarket BB #:301166 to a reported $2 billion in value, according to a Bloomberg article.

New investors include Squarepoint Capital, Portfolia, and Grosvenor Food & AgTech, joining existing investors including Tiger Global, Liberty Street Funds, Walleye Capital, Celtic House Asia Partners, and Apeira Capital.

GrubMarket CEO Mike Xu says the company’s mission is to “digitally transform the American food supply chain industry,” and is doing so through an ambitious acquisition strategy and implementation of its proprietary software.

Xu told Bloomberg the company’s is operating at an annual run-rate (performance based on current financials used as a predictor of future financials) of $1.5 billion, and is on track to achieve net profitability this year.

Johnny Tran, managing director of 301 Inc., venture arm for General Mills, said in a statement:

“GrubMaket’s software-based approach is reimaging produce distribution, automating tasks such as inventory management to reduce food waste.”

Since January 1, GrubMarket has announced 14 acquisitions, from software and payment firms to importers and wholesalers, including SunFed, JC Produce, and Produce Connection.

Pamela Riemenschneider is the Retail Editor for Blue Book Services.

News you need.

Join Blue Book today!

Get access to all the news and analysis you need to make the right decision --- delivered to your inbox.

What to read next

DoorDash expands sidewalk robot delivery in U.S.

DoorDash and Coco Robotics expands their partnership to offer sidewalk robot delivery for DoorDash customers in select U.S. markets.

FPAA discusses trade, tariffs, and food safety at annual Spring Policy Summit

FPAA recently brought together industry leaders, experts, and partners for its annual Spring Policy Summit

Zespri projects earlier kiwifruit crop with higher volumes

Zespri anticipates an early start this year with the first SunGold kiwifruit shipment arriving in Los Angeles and Philadelphia by mid-April.

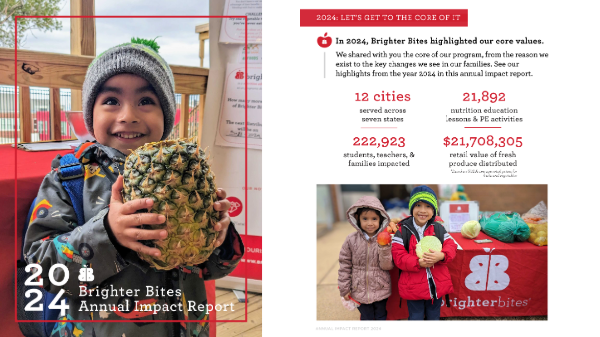

Brighter Bites 2024 Annual Impact Report shows $21.7MM in produce distributed

Brighter Bites, a national nonprofit that delivers fresh fruits and vegetables to families releases its 2024 Annual Impact Report.

IFPA to bring top leaders to Retail Conference and Golf Tournament

IFPA is gearing up for its Retail Conference and Golf Tournament, an exclusive event bringing together top retailers, suppliers, and leaders

Ben B. Schwartz & Sons launches custom ERP platform

Ben B. Schwartz & Sons recently launched its custom-built Enterprise Resource Planning platform Ben B. Access, expanding on its legacy system

Subscribe to our newsletter

© 2025 Blue Book Services. All Rights Reserved