Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

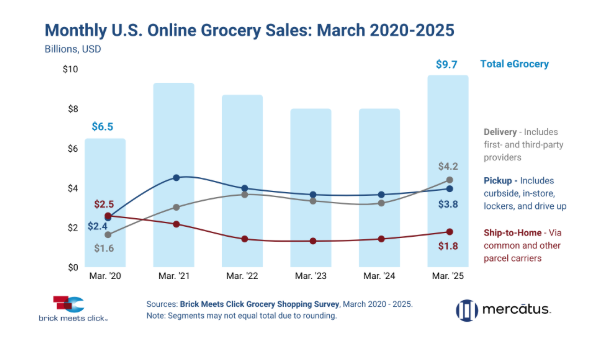

Barrington, Ill. – April 8, 2025 – The U.S. online grocery segment sustained its turbo-charged growth in March 2025, ending up 21% versus a year ago with $9.7 billion in monthly sales, according to the Brick Meets Click Grocery Shopper Survey fielded March 30-31, 2025, and sponsored by Mercatus.

Delivery continued to be the main driver of the topline increase, as it surged more than 30% year over year, due to expansion of its monthly active user (MAU) base.

The latest monthly performance gains for eGrocery sales reflect the ongoing impact of aggressive promotions and deep discounts on annual memberships and/or subscriptions that began around May 2024. These promotions have been offered by a broad range of grocery retailers, across Mass, Supermarkets, and third-party providers, and predominantly benefit Delivery although Pickup gets a boost that’s largely confined to Supermarket services.

“Delivery’s remarkable year-over-year rebound highlights the potency of promotional strategies that help customers save more money,” said David Bishop, Partner at Brick Meets Click. “And, memberships/subscriptions are becoming essential for retaining customers and driving more recurring revenue via gains in order frequency and average order values.”

March 2025 also marked five years since the COVID-19 pandemic was declared, which produced a rapid and profound impact on how U.S. households purchased their groceries. In August 2019, eGrocery rang up $2.0 billion in monthly sales in the U.S. Then seven months later in March 2020, eGrocery sales skyrocketed to $6.5 billion, a more than 200% increase. This initial surge accounted for about 60% of the total gains for eGrocery since the pandemic.

After peaking in early 2021, total eGrocery sales rebalanced through mid-2024, contributing another 20% of overall gains. More recently, there has been another 20% in gains driven by the uptick in subscriptions and memberships promotions, with March 2025 representing the 8th consecutive month of sales of over $9.5 billion.

Beyond the dramatic jump in sales, eGrocery has also experienced a significant shift in consumer demand by receiving methods. Prior to the pandemic, Ship-to-Home dominated, capturing 42% of all online sales, but it accounted for only approximately 18% in March 2025. It currently trails the other two methods by a significant gap: Delivery has increased from a 26% share in 2019 to a 43% share today, and Pickup has climbed from 32% to almost 39%.

In addition, more households are now likely to use multiple methods to receive their eGrocery orders during the month. Before COVID, 85% of MAUs used only one method during the month to get online orders, then, starting in March 2020 that share dropped to around 70% and has remained fairly consistent since then as the remaining households use multiple methods (some combination of Pickup, Delivery and/or Ship-to-Home).

Even with usage shifts, the three methods largely continue to attract different customers because of trip missions and personal preferences, making it important to monitor and measure each separately.

- Ship-to-Home’s utility was most pronounced in 2020 when lockdowns and shopping restrictions pumped up demand, but demand lessened as COVID-19 became endemic, only returning to growth in 2024.

- Delivery’s initial pandemic-fueled growth extended through 2022 before persistently high inflation drove a contraction that ended mid-last year when aggressive promotions reignited demand and growth for the service.

- Pickup saw its sales growth stall in 2021 as increased access to Delivery attracted more MAUs; however, its growth, much like Delivery, resumed in 2025 as promotions of memberships or subscriptions helped to lessen the cost of using this service offered by Supermarkets.

Overall, the pandemic motivated more households to try online grocery shopping. The share of U.S. households buying groceries online jumped from under 25% before COVID-19 to 57% in March 2020, and while it has gone as high as nearly 61% (Feb. ’25), it ended March 2025 at 57% as well. At the same time, MAUs are now more active online as the number of monthly eGrocery orders received has increased from 2.0 pre-pandemic to 2.6 as of March 2025.

“Customer expectations around online grocery have only increased since COVID-19 pushed many to give it a try,” said Mark Fairhurst, Chief Growth Marketing Officer, Mercatus. “Retailers that elevate the experience with relevant offers and meaningful rewards won’t just meet shoppers’ evolving needs—they’ll build stronger connections that fuel long-term growth,” he added.

For more information about March 2025 results, check out the latest Brick Meets Click eGrocery Dashboard or visit the eGrocery Monthly Sales report page for information about subscribing to the full monthly report.

About this consumer research

The Brick Meets Click Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on March 30-31, 2025, with 1,699 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in March 2024 (n=1,810). Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau.

The three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus drives digital transformation for retailers through an extensive suite of connected and contextualized commerce solutions. We enhance shopper engagement, tailor experiences to individual preferences, and cultivate enduring loyalty across retail businesses of every size. Our mission is to enable retailers to captivate customers, boost sales, foster retention, and deepen loyalty in a digital world. With our cutting-edge solutions, retailers can streamline operations, enrich customer experiences, and realize substantial growth. Embark on the digital transformation journey and unleash the full potential of your retail business with Mercatus.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com