Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

As the produce industry braces for another round of tariffs under President Trump, growers are facing mounting challenges on multiple fronts.

In the Southwest, intense desert heat is fueling quality concerns and increased insect pressure, while further south, Central Mexico is grappling with its worst drought conditions since 2011.

With Easter demand rapidly approaching, these factors exacerbate supply concerns just as new tariffs on Mexican produce exports are set to take effect on April 2. The industry now finds itself navigating an oddly familiar yet increasingly challenging landscape of uncertainty and volatility.

ProduceIQ Index: $1.26/pound, + up 1.6 percent over prior week

Week #13, ending March 28th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

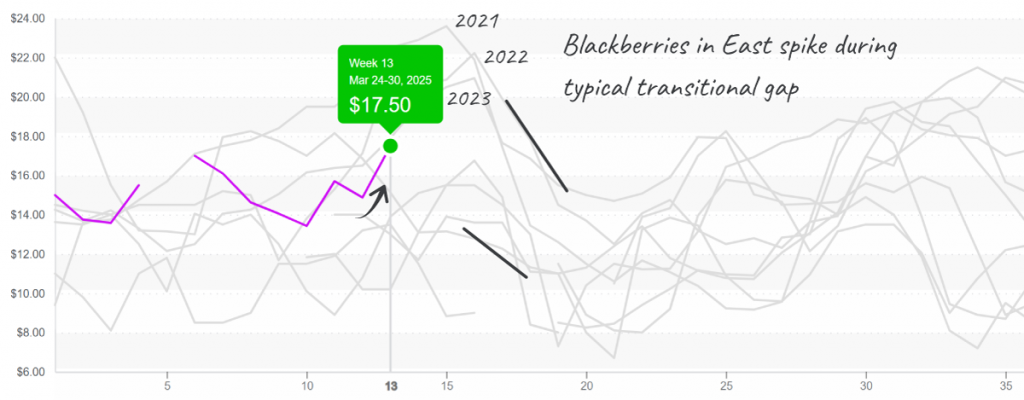

Blackberry Market Challenges

Blackberry prices soar, up +10 percent over the previous week. High heat in Central Mexico is tightening supply and decreasing shelf life. U.S. markets are mostly reliant on Mexican blackberry supply until July when growers in California and various states throughout the U.S. pick up production through the early Fall.

Blackberry prices begin to spike, which commonly lasts 6 weeks.

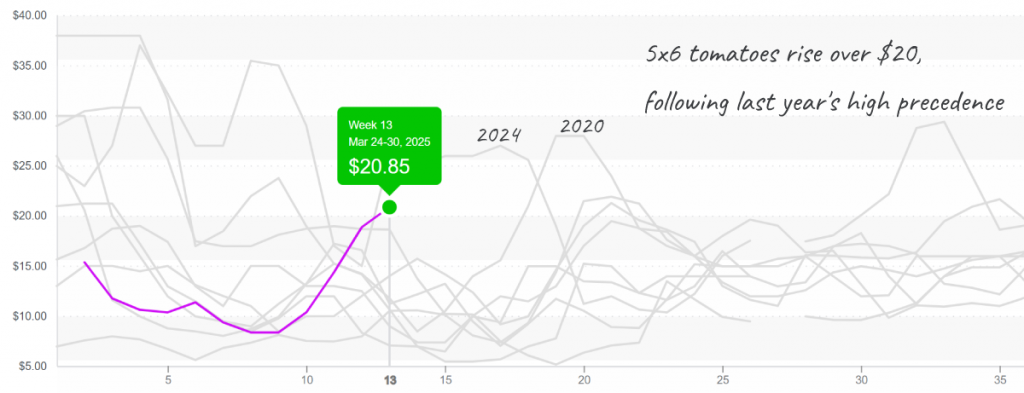

Tomato Prices Hit Decade-High

Tomato prices jump to a ten-year high. Low yields from cold-stricken growers in Florida, combined with seasonal transition in the East and West, are tightening supply and raising prices. High prices and lean supply are forecasted to persist through mid-April.

Mature green Tomatoes, 5×6 in the East, have risen and may follow last year’s pattern.

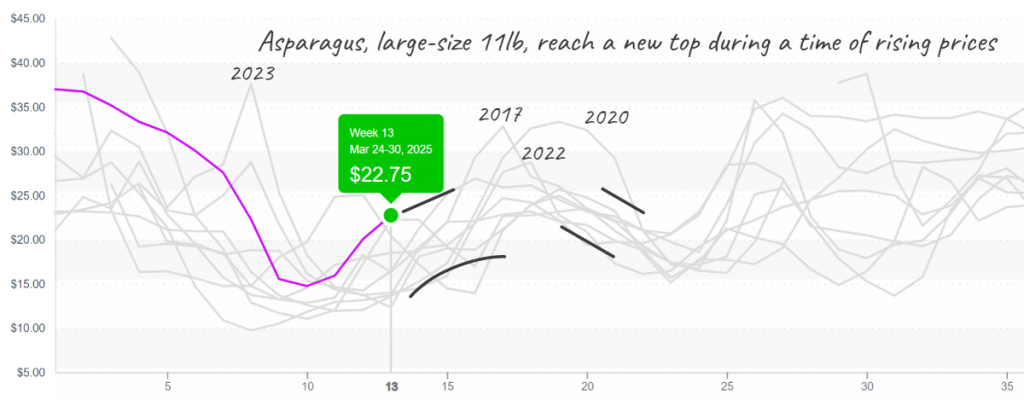

Asparagus Prices Continue Climbing

Up +14 percent over the previous week, average asparagus prices continue a stratospheric climb. Significantly lower yields from growers in Mexico are driving price increases. Peruvian production is beginning but it won’t be ready to fill the gap for 3-5 more weeks. Larger-sized asparagus is particularly short, expect requests to substitute from suppliers.

Asparagus, 11lb large-size, has an upward trajectory for the next 4 weeks.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.