Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

A broad range of produce commodities will feel the immediate effects of President Trump’s newly imposed tariffs.

While the USMCA excludes suppliers in Mexico and Canada, a 10 percent tariff now applies to fresh produce imported from all other countries. Affected nations include, but are not limited to Guatemala, Costa Rica, Honduras, the Dominican Republic, Colombia, Ecuador, Peru, Chile, Argentina, the Netherlands (and the rest of the European Union), and New Zealand.

Though the global trade war has been mildly subdued, tensions with China have escalated dramatically. As a result, increased input costs—such as packaging, machinery, and chemicals—are expected to raise U.S. production costs and push consumer prices upward. Shipping costs may also increase because of ongoing trade uncertainty.

In the short term, importers scramble to understand and adapt to the new 10 percent tariffs. In the long term, prices are forecasted to rise further due to higher input costs, shifting production patterns, and reduced competition in the marketplace.

ProduceIQ Index: $1.30/pound, flat over prior week

Week #15, ending April 11th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Easter promotions are in full swing, contributing to price spikes in key commodities like asparagus and berries. Strong holiday demand, combined with limited supply and reduced harvesting during Holy Week in Central and South America, is pushing prices higher. Expect both demand and prices to taper off after the holiday weekend.

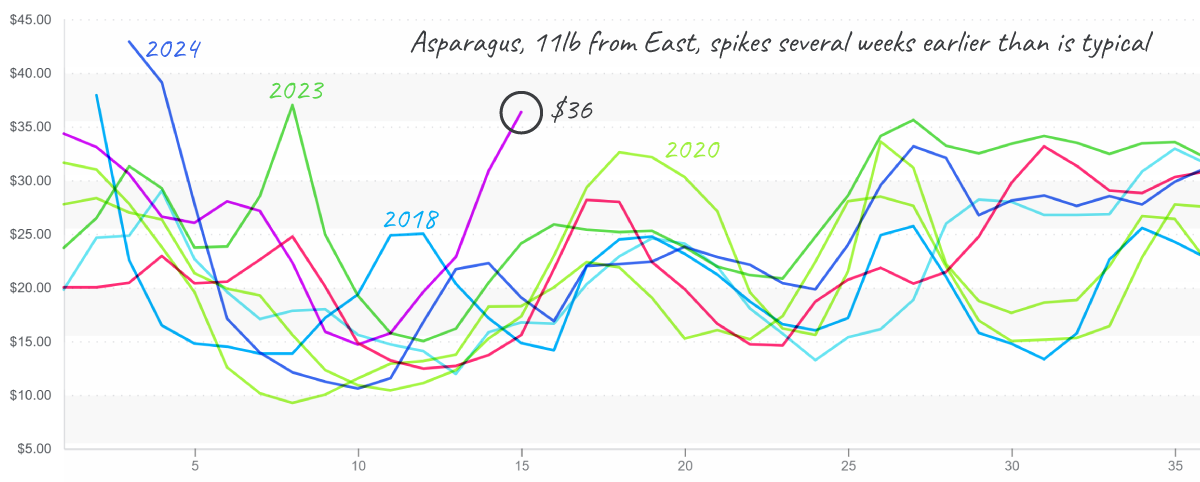

Asparagus prices are up +32 percent over the previous week due to strong demand and tight supply. Prices are expected to ease following Easter as Peruvian growers increase production. However, since Peru is subject to the new tariffs, import prices will now include an additional 10 percent cost based on declared value.

Asparagus prices spike rapidly, before the normal seasonal transition.

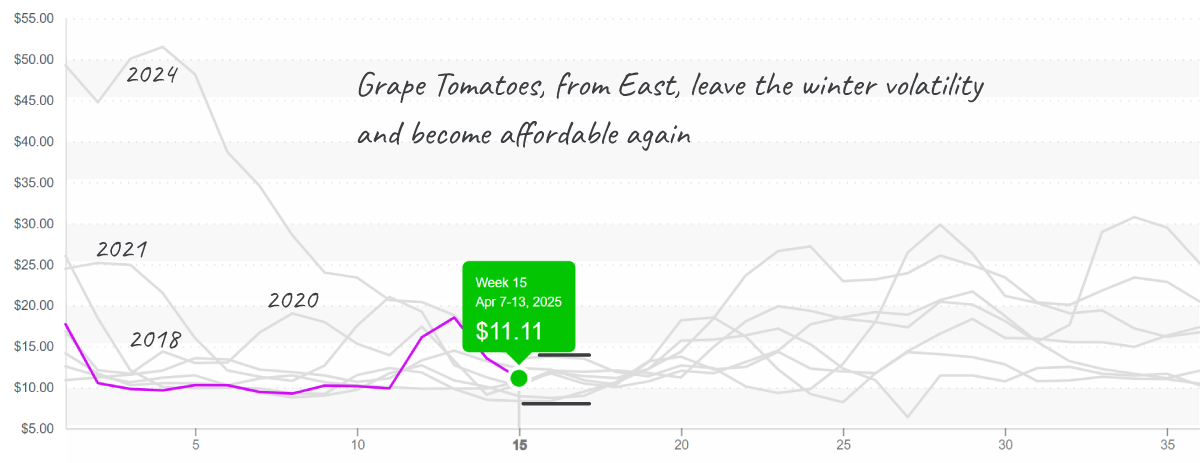

Tomatoes and lettuce offer promotional opportunities. Not all commodities are experiencing price hikes. Average tomato prices are down 28 percent from the previous week, thanks to increasing supply from growers in Florida and Mexico. Quality remains excellent, with round, grape-type, and plum-type tomatoes priced attractively for retail promotions. Grape tomato prices, in particular, have entered affordable territory and are well-positioned for aggressive promotion.

Grape Tomato prices fall into affordable territory and are ready for promotion.

Lettuce markets remain steady despite heat-related quality issues in the West. Western growers have executed a smooth transition from Yuma, AZ to California’s Salinas Valley. Prices for lettuce and leaf commodities remain well below average for Week 15, providing good promotional opportunities.

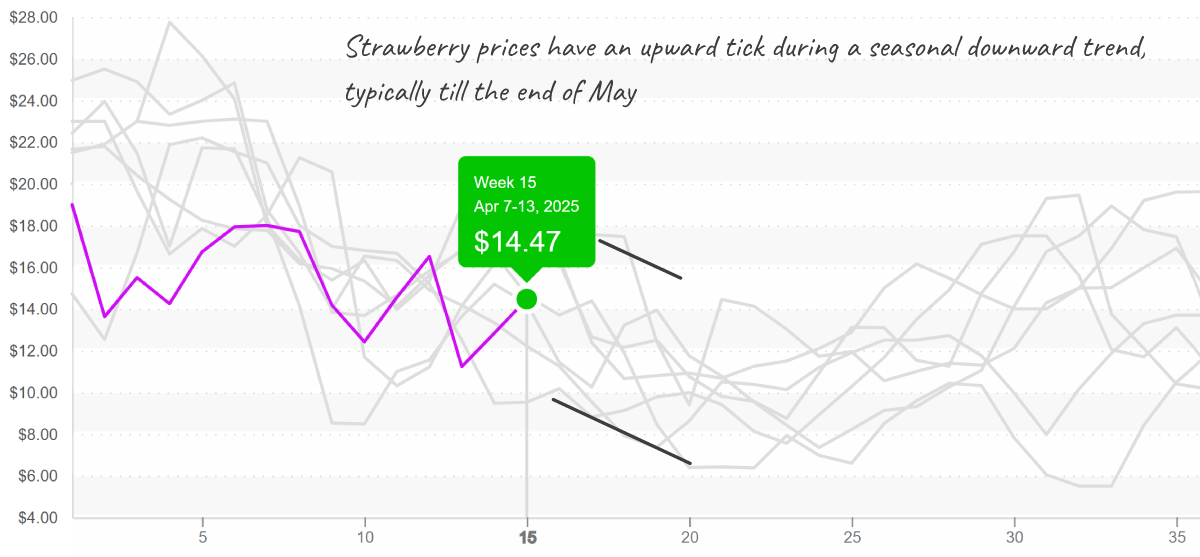

Strawberry prices are on the rise—up 22 percent over the previous week—due to declining production in Florida and increased Easter demand. Prices have reached $14 in Western markets, signaling the end of recent ‘sweet deals.’ Although California growers are working hard to boost supply, it may take another one to two weeks before supply catches up with demand.

Strawberry prices, $14, in the West bounce off the floor.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.