Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

May is looking like it could be an expensive month for fresh produce. Usually, warmer and more stable weather helps boost supply from growers in the U.S., Canada, and Mexico.

But this year, high prices for popular items like berries and avocados are pushing the ProduceIQ index to its highest point in a decade.

Additionally, the weather’s expected to be warmer and drier across much of the U.S., and new tariffs are adding even more pressure on prices. With holidays like Cinco de Mayo, Mother’s Day, and Memorial Day driving up demand, we might just see some record-breaking price trends next month.

ProduceIQ Index: $1.32/pound, -3.7 percent over prior week

Week #17, ending April 25th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Blueberries are one of the biggest culprits, with prices hitting a ten-year high at $34. Production is still lagging behind expectations, and while the seasonal slowdowns are nearly over, major improvements probably won’t come until mid to late May.

Mexico’s supply is dropping off faster than anticipated, and Florida is facing quality issues that have kept production low. In Georgia, early-season weather challenges have caused delays, but growers just started harvesting lightly this week. They’re expecting a slight increase by the weekend, with more significant growth coming next week. Meanwhile, in California’s Central Valley, harvests are also behind schedule, with only small-scale picking expected to begin next week.

Blueberry prices persist at high levels before new growing regions kick in.

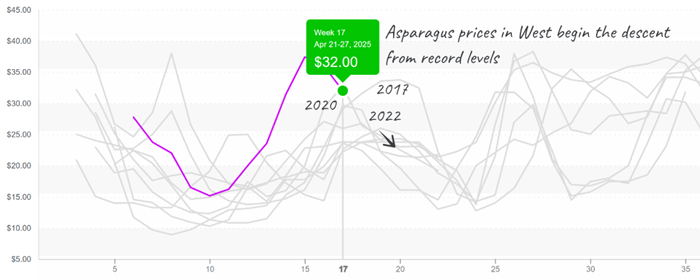

Asparagus is also in short supply across the U.S. Mexico’s season is winding down, and domestic production in Washington, California, and soon New Jersey and Michigan is limited. Peru is stepping in to help meet demand, especially along the East Coast, but prices are staying high due to strong demand. This market is expected to stay strong through May.

Asparagus prices in the West descend to $32 from $38, typically fall over the next 8 weeks.

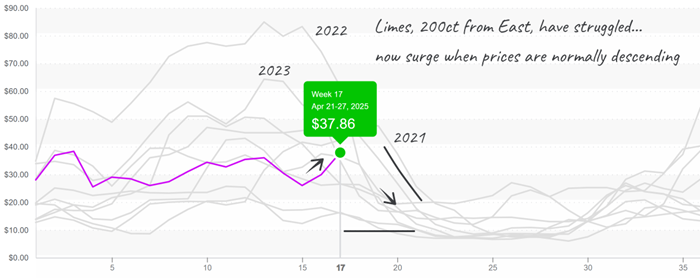

Lime prices are another story. With supply still tight this week and expected to stay that way, shippers are catching up after shortages during Holy Week. Demand for limes will only grow with Cinco de Mayo celebrations just around the corner, likely pushing prices even higher. Smaller fruit sizes are more available, but the larger ones remain scarce. We can expect these high prices and limited supply to continue in the coming weeks.

Lime prices, 200ct cross Texas, strengthen despite a pattern of increased supply over the next weeks.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

Bio

Mark Campbell is an industry veteran with over 20 years of produce experience. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms. He later served as CFO advisor to several produce growers, shippers, and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers from trading with greater access and efficiency. This led him to cofound ProduceIQ.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.