Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Florida growers have a lot on their plates this week. With temperatures pushing into the 90s and little to no rain in the forecast, crops like bell peppers, beans, and squash could start feeling the heat.

Even with neutral ENSO conditions and cooler ocean temperatures than last year, early forecasts for the 2025 hurricane season still point to above-average activity, keeping growers across the Southeast on edge as they prepare for a potentially volatile season.

Adding to the mix is big news on the trade front: the U.S. has officially started the process to end the tomato suspension agreement with Mexico.

Many Florida farmers see the move as a long-overdue win for domestic tomato growers, as a 20.91 percent duty is expected to be imposed on Mexican imports beginning in July.

The FPAA, which advocates for free trade with Mexico, is concerned that the change will drive up prices for U.S. consumers, particularly for vine-ripened tomatoes. Most tomato production that feeds the U.S. has moved to Mexico, particularly during the winter season.

While the decision isn’t expected to immediately impact the spot market on tomatoes, it will almost certainly shake up the supply chain as Mexican growers begin facing new anti-dumping duties.

ProduceIQ Index: $1.37/pound, +5.4 percent over prior week

Week #16, ending April 19th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

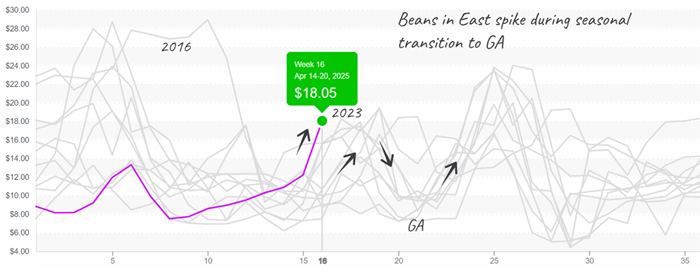

Meanwhile, price trends across multiple commodities are showing significant shifts. Bean prices have jumped to a ten-year high, now averaging $36 in the West and $18 in the East. This wide price spread isn’t explained by the difference in freight costs. Production in Mexico and Florida is down, but growers in California and Georgia are expected to ramp up harvests in the coming weeks. Still, buyers should expect elevated prices through early May.

Bean prices spike around the supply gap and Easter pull.

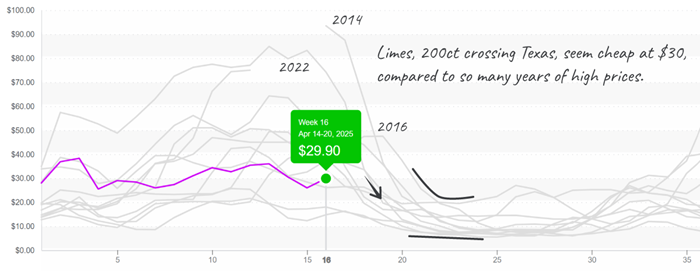

Limes are also seeing a price bump, up by +14 percent over the previous week. The seasonal dip in Holy Week harvests helped push prices higher, though overall, lime prices remain below the seasonal average for week #16. Strong demand is expected to continue through Cinco de Mayo, but prices should begin trending downward as Mexican supply increases.

Limes, 200ct crossing Texas, actually seem like a good deal at $30, though they’ll get cheaper in May.

Grapes are following a similar pattern. Prices are up by +12 percent over the past week, driven by quality concerns, especially among green varieties. Chilean production is winding down, and Mexican growers are still about two weeks out from hitting the market. Until then, prices are expected to rise steadily as supply tightens.

Red grape prices gradually rise as Chilean production declines.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.