Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Focusing on produce prices is hard when the year’s biggest show is just around the corner. We are only one week away from the fresh produce industry’s annual pilgrimage to IFPA, and the anticipation is palpable.

Even though we’re clearly buzzed with the prospect of connecting with you in person at the show, we can’t neglect our duty to share what we’ve learned over the weekend. So, without further ado, here’s your weekly highlights:

Though slightly down over the prior week, at $1.23/pound, overall produce markets remain 12 percent higher than in any prior year.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.23/pound, down -0.8 percent over prior week

(Week #40, ending October 6th)

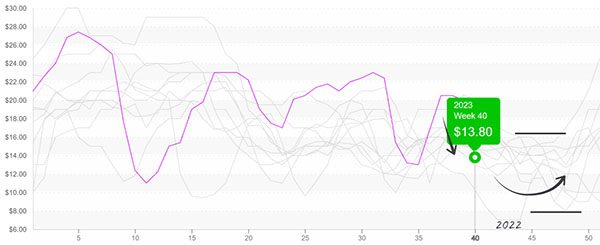

Raspberry supply is officially in recovery. Although import volume from Mexico is still lower than the historical average for week #40, supply from Mexico is rising. Accordingly, raspberry prices are down -31 percent over the previous week. If supply continues to increase as expected, there should be many opportunities for promotion over the next few weeks.

Raspberry prices crashed from $22 to $13; prices in 2022 reached as low as $7 over the next four weeks.

Up +38 percent over the previous week to $13, honeydew prices encroach on record-breaking territory. A small gap in supply is forming due to declining production in Central California. Growers in Arizona and Mexico are a week or two away from being able to fill the remaining gap. Anticipate mild price volatility.

You can’t walk down the produce aisle without feeling the effects of the Western fall transition on prices; cauliflower is no exception.

After weeks of declining prices, cauliflower markets are on the rise. Production in the Salinas/Watsonville area is beginning to fade, and growers in Arizona won’t be ready for five more weeks at least. Prices will likely fluctuate with supply as we enter a seasonal period of volatility for cauliflower markets.

Cauliflower prices lift to $16 at the start of the volatile price season; last year, 2022, prices increased past $60.

At $33, average grape prices are holding tight to an unprecedented ten-year high. Prices reflect the damage caused by Hurricane Hillary. Fortunately, last week’s heavy rain, caused by an atmospheric river, missed rain-ravaged growing regions in California.

Domestic grape supply will remain lower than the historical average through October. Prices may decrease in November when the burden of supply switches to importers.

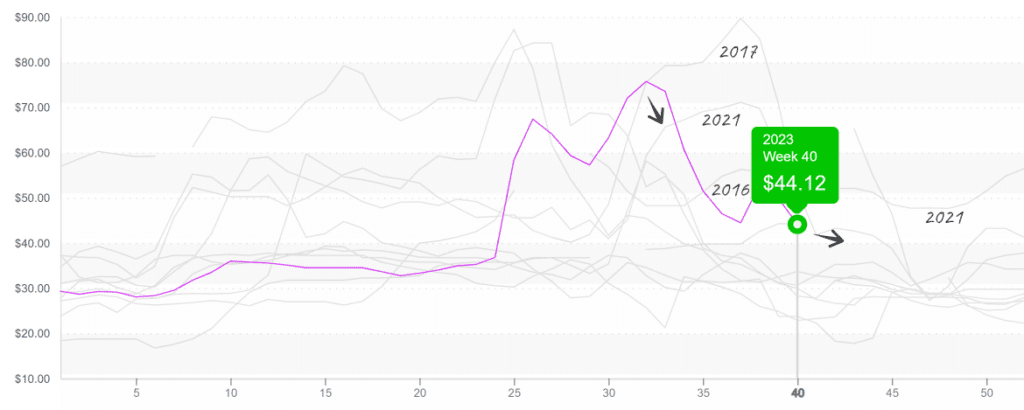

Avocado supply is improving daily, and hass prices are slightly below average for week #40. The old Loca crop and the new Aventajada crop are both available, and Mexican supply is strong; however, Peruvian production is nearly finished.

Avocado Hass (48ct) prices fall to $44 after another bumpy fall; prices typically descend from here through week 48.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance