Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

The produce industry has dodged the tariff bullet…at least for now. While the industry has narrowly avoided a direct hit, long-term prices may rise due to the increased costs of materials used to grow, pack, and transport fresh produce.

Meanwhile, a break in severe weather brings some relief to the South and Midwest after a dangerous week of flash floods and tornadoes across 12 states. These storms not only left communities waterlogged but also disrupted regional supply chains.

Looking ahead, weather patterns across the U.S. are shifting dramatically. In Chicago, highs are expected to drop into the upper 40s, while Phoenix temperatures will soar into the 90s by Tuesday. The heat surge in the West will likely mark the end of Yuma’s produce season and signal the annual transition of production back to California’s Central Valley.

ProduceIQ Index: $1.30/pound, + up 3.2 percent over prior week

Week #14, ending April 4th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Market Updates by Commodity

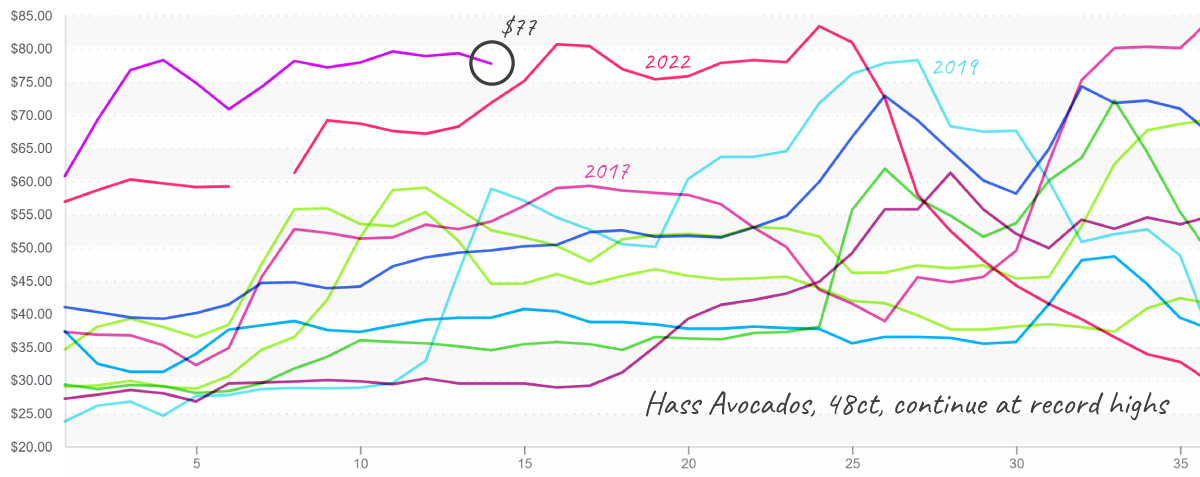

Avocado prices dip over the previous week. However, this may not signal a long-term trend. The decrease appears to stem from growers offloading inventory in anticipation of tariffs that ultimately didn’t materialize.

Looking at Week #15, overall volume is projected to be historically low. California growers are ramping up efforts, but they are unlikely to fully offset the reduced supply from Mexico. Expect prices to climb steadily through Easter, as Holy Week celebrations are expected to further limit harvest activity.

Avocado prices, Hass 48ct, continue at record highs, surpassing the fiasco in 2022

Blueberries prices soar, up +28 percent over the previous week as unseasonably warm weather in Chile and Mexico reduce supply. Growers in Florida are ramping up production, and supply should steadily improve over the next few weeks as new growers come online.

Blueberry prices reach a higher peak during a normal time of turbulent transitions.

Asparagus prices continue their meteoric trek, average prices are up +30 percent over the previous week. Heat in Mexico and slow-to-start Peruvian production are tightening supply, particularly for large and jumbo-sized grass. Peruvian production is ramping up, though won’t be ready to fill the gap until the end of April.

Asparagus prices typically ascend for a few more weeks until the decline begins in May.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

CORRECTION: April 8th, 2025 — In a story published Monday, April 7th, 2025 about ProduceIQ’s market highlights, ProduceIQ reported incorrectly that tariffs are on hold and the industry has avoided a direct hit. The correct information is that produce commodities protected under the United States-Mexico-Canada Agreement are excluded from tariffs, however, many countries including countries in Central and South America will receive at least a 10 percent tariff. We regret the error.